Meeting Strategies for Financial Advisors: How to Optimize Location for Better Client Experience

From 2020 to 2025, financial advisors experienced a fundamental shift in how they meet with clients. What began as a temporary response to global disruption became a lasting change in client expectations and advisor workflows.

Before this period, the meeting location was largely implicit. Advisors met clients in offices by default, with limited variation. Today, location is a deliberate choice, one that influences client experience, advisor productivity, and operational efficiency.

As appointment setting for financial advisors becomes increasingly client-driven and automated, how meetings are structured matters just as much as when they occur. Clients now expect flexibility in how and where meetings take place. Virtual, phone, office, and offsite meetings coexist, and the ability to offer choice has become a differentiator. Client meetings now require a more intentional process, leveraging digital tools to enhance client engagement and build trust in the financial services industry.

As a result, meeting location has evolved from a logistical detail into a strategic lever. Automation and technology have become essential for ongoing dialogue and follow-up, freeing up time for advisors to focus on personal interactions. Advisors who design their location strategy intentionally are better positioned to convert prospects, retain clients, and scale their practice without adding operational friction.

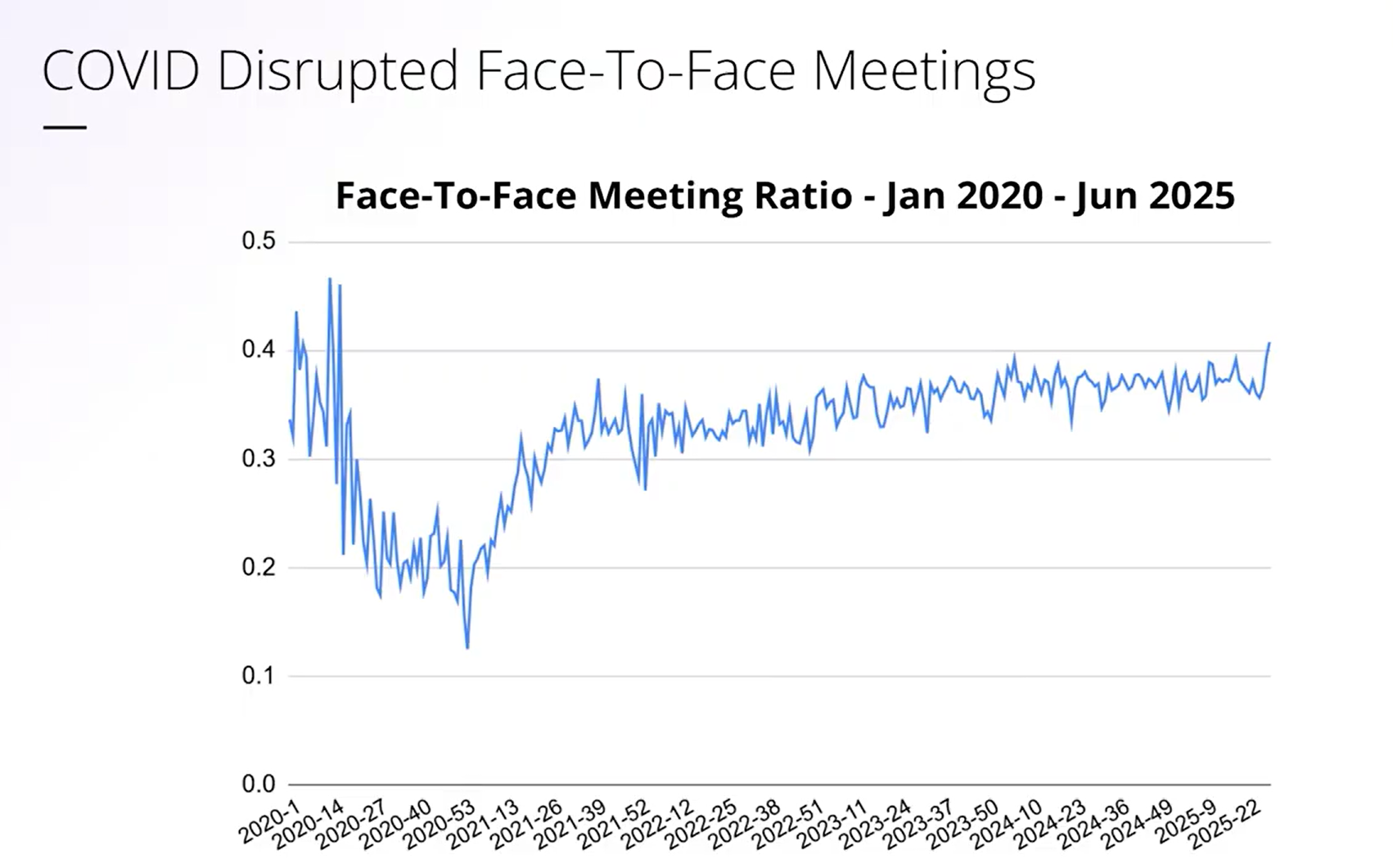

An analysis of over one million advisor meetings conducted between January 2020 and June 2025 reveals a clear and lasting shift in meeting behavior.

During the peak of the COVID period, in-person meetings dropped sharply, reaching lows of approximately 12 percent of all advisor meetings. While in-person meetings gradually rebounded as restrictions eased, they never returned to pre-2020 levels.

Instead, a new equilibrium emerged. Virtual and phone meetings remained a core part of advisor workflows, while in-person meetings became more selective and purpose-driven. Most advisors are now implementing structured follow-up processes and leveraging automation in their prospecting to maintain personal connections and ensure a consistent, repeatable client engagement process.

The key takeaway is not that in-person meetings declined, but that the default behavior disappeared.

Clients now expect options. Advisors now operate across multiple formats. And firms that rely on a single, unstructured approach to meeting location risk are falling behind peers who treat location as a strategic input rather than an operational afterthought.

Meeting location is no longer passive. It is a controllable variable that directly affects experience, efficiency, and growth. Many advisors use digital tools and automation to streamline client communication, enabling more meaningful one-on-one interactions and enhancing the overall prospecting process.

Why Meeting Location Strategy Matters

Client Experience

Clients want control over how, where, and when they meet. Convenience, accessibility, and clarity all influence how clients perceive professionalism and trust. Practicing active listening and empathy during client meetings helps clients feel confident and understood, laying the foundation for strong relationships and effective closing strategies.

Effective appointment setting for financial advisors goes beyond availability. If you let your clients choose a meeting format that fits their preferences, whether virtual, phone, or in person, they arrive more engaged and confident. To communicate effectively, avoid jargon and use clear language, simple charts, and relatable client success stories to make complex information accessible and help clients feel comfortable and engaged. Conversely, unclear or rigid location options introduce friction before the conversation begins.

Advisor Productivity

Without structure, hybrid availability can quickly erode productivity. Advisors may find themselves context-switching throughout the day, handling low-value meetings in high-energy time blocks, or managing scheduling manually.

Leveraging resources such as educational tools and support materials, along with delegating preparation tasks, can help advisors focus more on strategy and client engagement during meetings.

A defined meeting location strategy allows advisors to align meeting types with energy levels, complexity, and business value, resulting in better time use and reduced burnout. Implementing an effective client engagement strategy and using automation can also free up time for advisors to develop their soft skills.

Operational Efficiency

Unstructured location management leads to back-and-forth emails, double bookings, room conflicts, and administrative overhead. A structured approach reduces these inefficiencies by establishing clear rules, automating processes, and fostering predictability.

Using checklists and a CRM system can help automate processes, organize client information, and ensure nothing slips through the cracks during client meeting preparation.

Systematizing the client meeting preparation process also helps advisors manage their time more effectively, thereby improving operational efficiency.

Business Growth

Meeting location strategy directly influences outcomes. Advisors who align meeting formats with client intent and lifecycle stages often see higher prospect conversion, stronger client retention, and more efficient use of senior advisors’ time.

Building client loyalty and strong client relationships is essential for business growth, as authentic connections and trust lead to long-term retention and advocacy.

Targeted marketing campaigns to different client segments are also crucial for growth and longevity. Additionally, building a community through client engagement fosters trust and loyalty, resulting in long-term client relationships.

Five Advisor Personas and What They Reveal About Location Strategy

Usage patterns show that advisors typically fall into one or a combination of five personas. Each reflects a different approach to managing meeting locations as practices grow. Understanding your ideal clients and personalizing communication plans to their preferences can enhance engagement and improve the prospecting process, helping advisors attract and build trust with high-quality prospects.

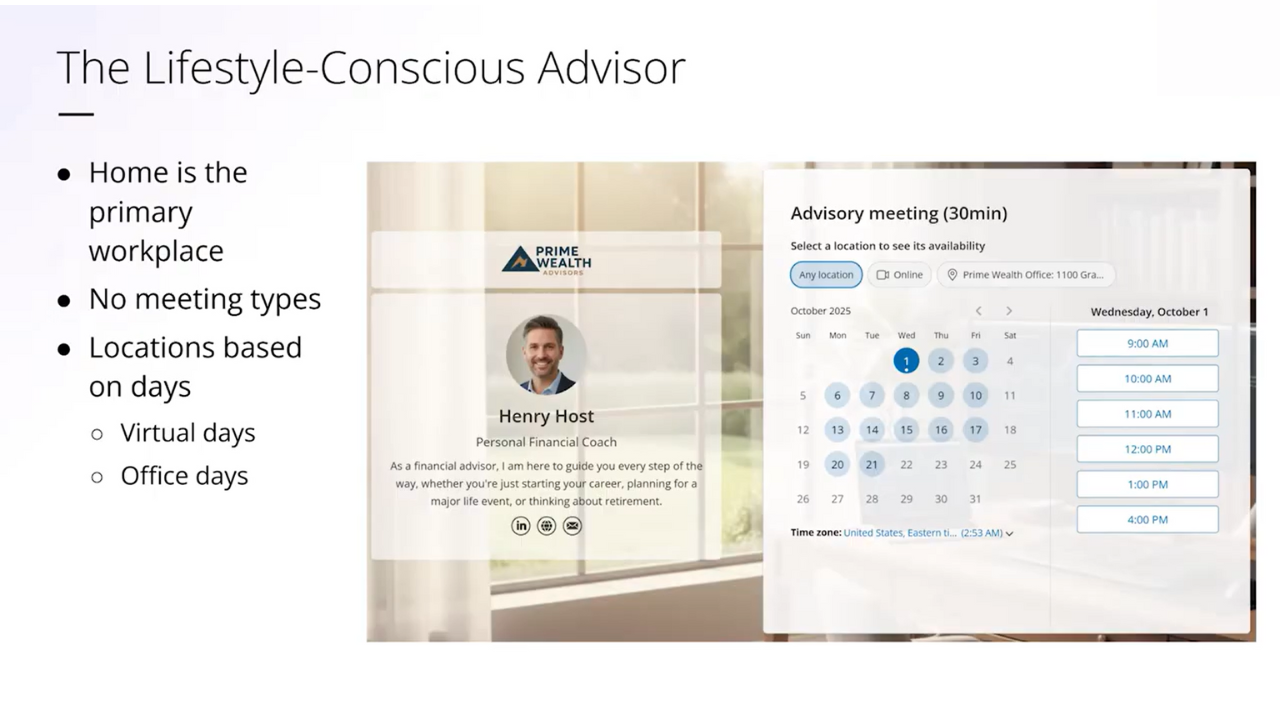

Persona 1: The Lifestyle-Conscious Advisor

These advisors work part-time or operate from home, prioritizing work–life balance.

Strategy Advantage: A predictable hybrid routine that balances availability with personal boundaries.

Best Practices:

-

Assign fixed virtual days and fixed office days

-

Clearly label availability by location

-

Use integrated video tools to reduce friction

-

Leverage digital tools to schedule regular, personalized check-ins with clients to boost engagement

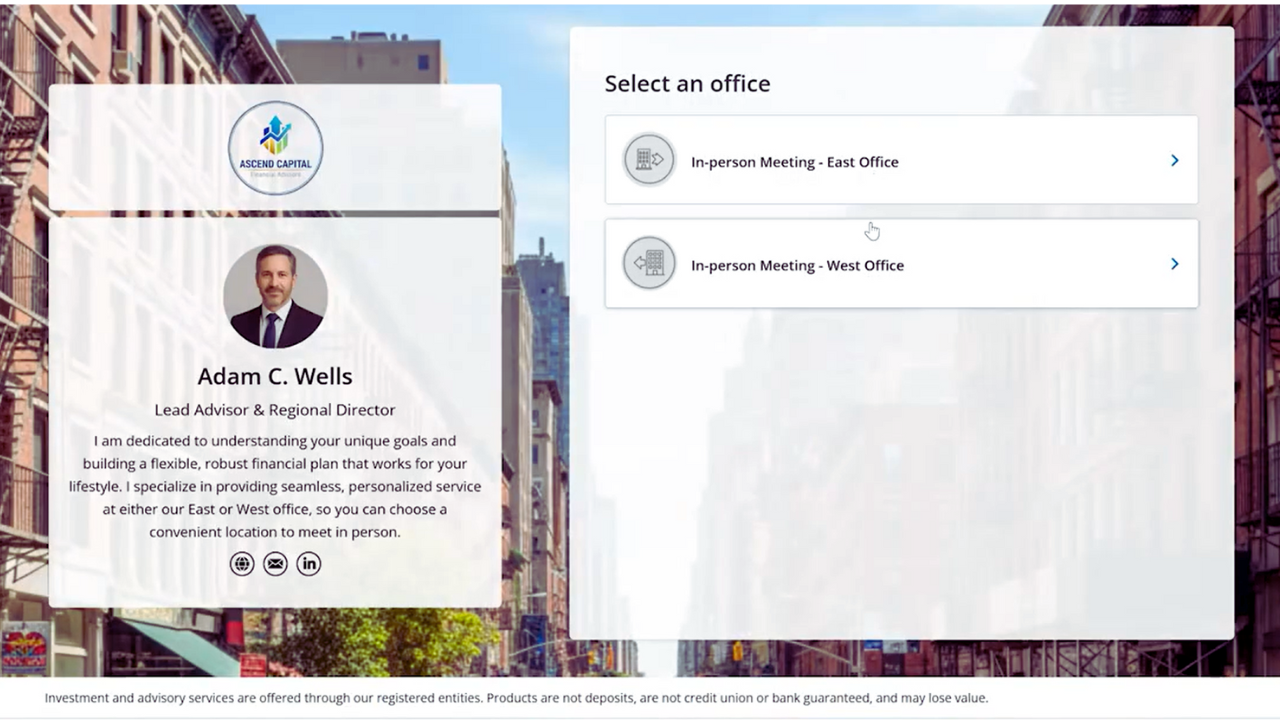

Persona 2: The Multilocation Advisor

Often found in banks or large firms, these advisors serve clients across multiple branches.

Strategy Advantage: Expanded geographic coverage without duplicating advisor headcount.

Best Practices:

-

Centralize availability using a booking hub

-

Apply location-based rules (e.g., specific branches on set days)

-

Customize buffers and notifications per location

-

Provide relevant information and resources tailored to clients at each branch location

Business Impact: Improved clarity for clients and better utilization across branches.

Persona 3: The Solopreneur Advisor

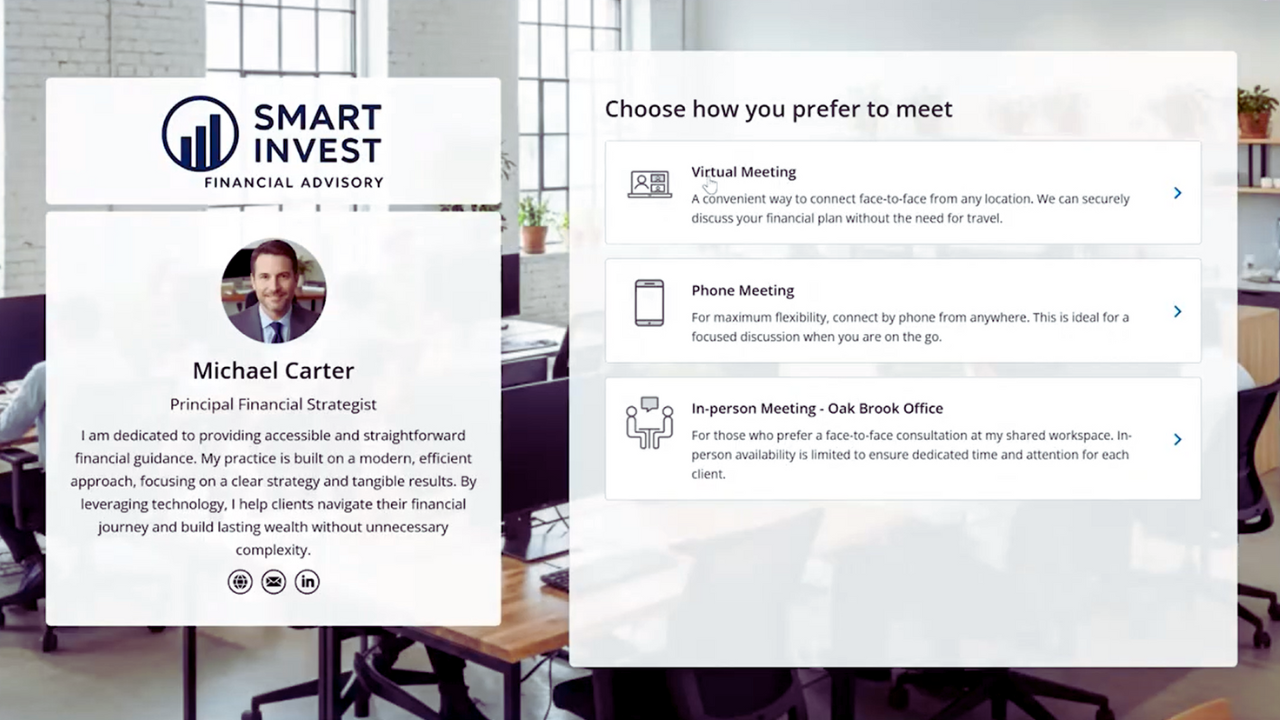

.png?width=1280&height=720&name=Freelance%20Financial%20Advisor%20(1).png)

Independent advisors early in their journey rely on flexibility to acquire leads.

Strategy Advantage: Offering multiple meeting locations reduces barriers for prospects.

Best Practices:

-

Provide video, phone, office, and off-site options

-

Offer tiered meeting lengths (15, 30, 60 minutes)

-

Organize meeting types using clear categories

-

Leverage marketing and host client events to attract new leads

Business Impact: More leads, broader reach, and frictionless early-stage growth. Consistent follow-through is essential to convert prospects into clients and build lasting relationships.

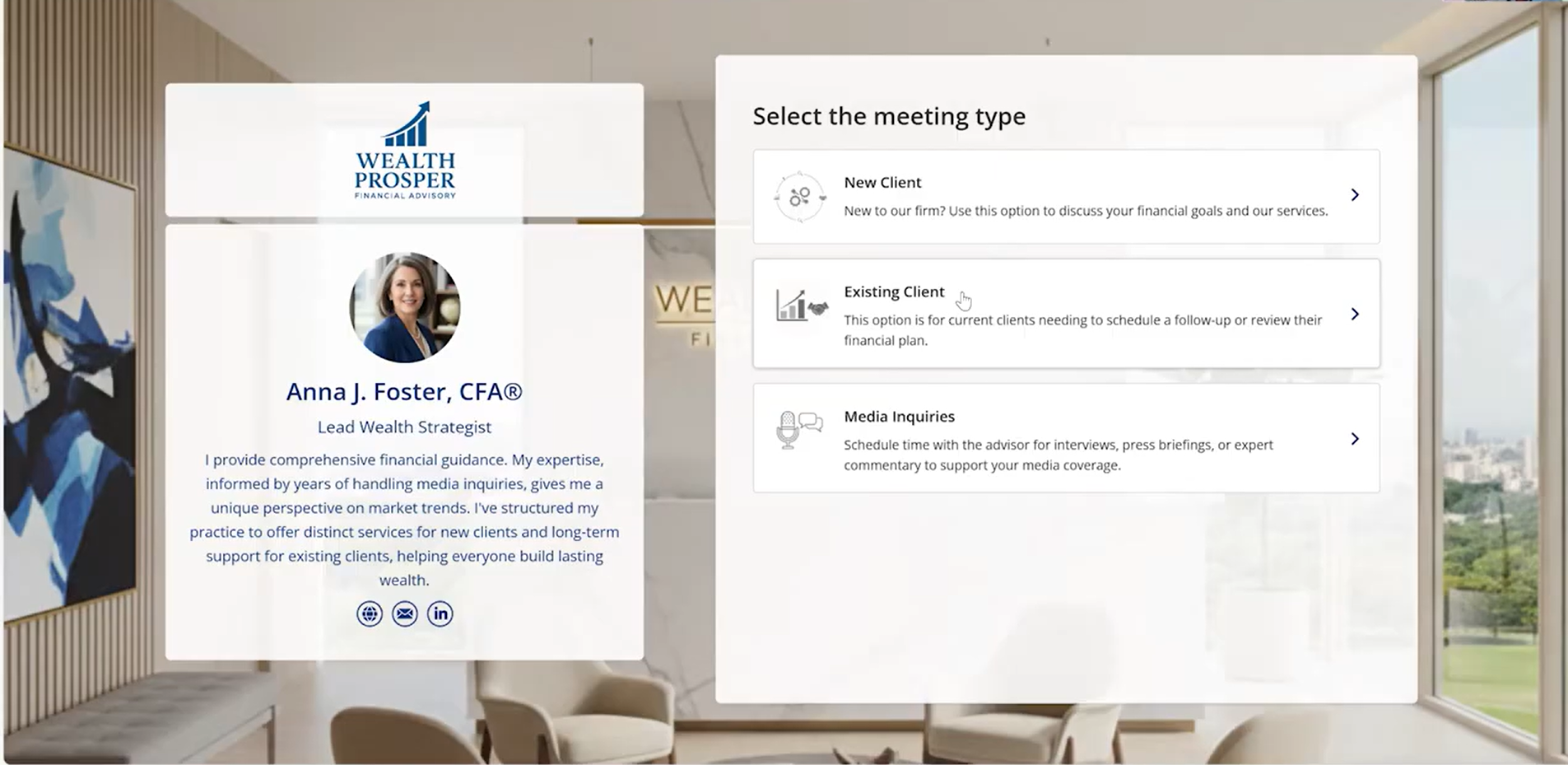

Persona 4: The Productive Senior Advisor

Senior advisors treat time as a high-value, limited resource.

Strategy Advantage: Meeting types are intentionally designed around impact. Leveraging their expertise, senior advisors provide tailored advice and guide clients through complex financial decisions, ensuring each meeting delivers maximum value.

Best Practices:

-

Quick introductions via phone

-

Discovery meetings in the office

-

Follow-ups via virtual or office formats

-

Separate booking paths for prospects, clients, and media

Business Impact: Better qualifications, stronger relationships, and optimized billable hours.

Persona 5: The Operationally Efficient Advisor

These advisors work in shared environments with limited meeting rooms.

Strategy Advantage: Reliable scheduling without conflicts.

Best Practices:

-

Link in-person availability to room calendars

-

Restrict office meetings to available days

-

Offer virtual alternatives automatically

-

Use automation to streamline scheduling and follow-up, ensuring no client is overlooked

Business Impact: Lower administrative overhead and a more dependable client experience. Regular follow-ups and check-ins with clients reinforce relationships and open the door to additional service offerings, such as investment management.

The Technology Framework That Enables Strategic Location Management

Strategy must be supported by the right infrastructure.

Modern appointment-setting for financial advisors relies on platforms that manage multi-location availability without creating operational complexity. Leveraging digital tools, such as a CRM system, is essential for enhancing client engagement and ensuring easy access and ongoing dialogue.

Platform Setup Essentials

-

Connect Google or Microsoft calendars

-

Integrate video tools such as Zoom or Webex

-

Customize confirmation and reminder notifications

-

Integrate a CRM system to centralize client information and automate follow-up tasks

Availability Configuration

-

Define time blocks tied to meeting locations

-

Prevent overlap across locations

-

Align schedules with energy and priority levels

-

Use automation to optimize availability and ensure timely responses to client requests

Booking Pages and Hubs

-

Use single booking pages for simple practices

-

Use booking hubs for teams or multi-location setups

-

Organize meetings with categories for clarity

-

Personalize booking pages to enhance client engagement and make the scheduling process more client-friendly

Operational Controls

-

Apply buffers, lead times, and routing rules

-

Prevent double bookings across advisors or rooms

-

Use conditional availability where needed

-

Standardize the process for meeting scheduling and follow-up to ensure consistency and efficiency

How to Design a Location Strategy That Scales With Your Practice

A strong meeting location strategy is not about offering every option. It is about aligning availability, intent, and value in a way that scales as your practice grows. Aligning your meeting strategies with clients' long-term financial planning and their financial future is essential for scalable growth.

Preparing for client meetings well in advance allows advisors to provide the best advice and solutions.

The most effective advisors deliberately design their location strategy, using business logic rather than convenience.

Step 1: Anchor Your Strategy to Your Advisor Persona

Start by identifying your dominant advisor persona—or the combination that best reflects your current practice. Your persona determines how much flexibility you can realistically offer and where structure is required. Identifying your ideal clients is also crucial, as it allows you to tailor your meeting location strategy to better serve their specific needs and preferences.

For example:

-

A solopreneur may optimize for reach and accessibility.

-

A senior advisor may optimize for qualification and time protection.

-

A multi-branch advisor may prioritize clarity and coverage.

There is no “ideal” persona, only alignment between strategy and reality.

Step 2: Define Your Core Meeting Channels (Not All Possible Ones)

Resist the temptation to offer too many formats. Instead, define a core set of meeting channels that support your business goals. Establishing a clear process for client meetings—including setting a clear agenda—helps manage expectations and ensures all critical topics are covered.

Typical channels include:

-

In-office

-

Virtual (video)

-

Phone

-

Select offsite meetings (where relevant)

Each channel should have a clear purpose. If a meeting format does not serve a specific client or business need, it should not be offered.

Step 3: Tie Availability to Business Value and Energy Levels

High-performing advisors do not treat all time blocks equally.

Instead, they:

-

Reserve high-energy periods for high-value meetings

-

Batch similar meeting types together

-

Limit context switching between locations

For example:

-

Introductory calls may be limited to phone-only slots.

-

Discovery meetings may be offered only in-office on specific days.

-

Follow-ups may default to virtual unless complexity requires otherwise.

This alignment protects advisor energy and improves meeting quality. Consistent follow-through after meetings is essential to ensure that action items are completed and progress is made toward clients' financial goals.

Step 4: Map Meeting Locations to the Client Journey

Different stages of the client relationship require different levels of depth and presence.

A common mapping looks like this:

-

Early-stage prospects → phone or virtual

-

Qualified prospects → in-office or structured video

-

Ongoing clients → virtual or in-office based on complexity

-

Reviews or multi-party meetings → formats that support collaboration

Mapping meeting locations to the client journey helps strengthen client relationships by fostering trust, addressing client concerns, and building an emotional connection through tailored interactions. Additionally, providing meeting summaries with clear action items for both parties after each meeting reinforces accountability and ensures ongoing engagement.

This ensures meeting locations support outcomes—not habits.

Step 5: Standardize the Client Booking Experience

Once internal decisions are made, they must be clearly presented to clients.

Effective advisors:

-

Use branded booking pages

-

Clearly explain meeting formats and expectations

-

Reduce cognitive load by guiding clients toward the right option

Personalizing the booking experience not only streamlines the process but also enhances client engagement and satisfaction by making clients feel valued and understood.

Clarity at the booking stage sets the tone for the entire relationship.

Step 6: Use Rules and Automation to Enforce Consistency

Without automation, even the best-designed strategy breaks down.

Rules around buffers, lead times, routing, and conditional availability ensure:

- No double bookings

- No room conflicts

- No manual intervention as volume grows

Consistency is what allows a location strategy to scale.

Advanced Best Practices for Driving Growth With Location Strategy

Once a foundational strategy is in place, advisors can use meeting location as a lever for growth, not just efficiency. Discussing assets, portfolio, investments, and risk tolerance during meetings ensures that strategies are tailored to each client's long term goals, helping them feel secure and confident in their financial plans.

Financial education is also crucial for retaining clients over time, as it provides relevant information and helps engage with family members and the next generation. Hosting client appreciation events fosters goodwill and deeper engagement, further strengthening relationships and expanding the advisor's network.

Design Choice Without Overwhelm

Clients value choice, but too many options create hesitation.

Use:

-

Categories

-

Clear labels

-

Recommended meeting paths

-

Relevant information and resources to help clients make informed choices about meeting formats

Guide clients toward the right format rather than asking them to decide blindly.

Separate High-Value and Low-Value Meetings Explicitly

Not all meetings deserve equal access to your calendar.

High-performing advisors:

-

Restrict in-person meetings to qualified or high-impact interactions

-

Route low-commitment conversations to phone or virtual formats

-

Protect senior advisor time through structured access

-

Prioritize high-value meetings by leveraging expertise and presenting tailored investment strategies to demonstrate credibility and address client goals

This separation directly improves profitability and focus.

Keep Availability Predictable

Predictability builds trust.

Clients are more likely to book, and keep meetings when:

-

Availability follows a consistent pattern

-

Locations are clearly communicated

-

Expectations are set upfront

Predictable availability not only builds trust but also fosters client loyalty, as clients feel valued and confident in the advisor’s commitment to their needs.

Unpredictable schedules undermine confidence and create friction.

Maintain Virtual Access as a Baseline, Not a Backup

Virtual meetings should not be treated as a fallback option.

They:

-

Improve accessibility

-

Reduce no-shows

-

Support inclusivity for clients with mobility, location, or time constraints

Leveraging digital tools in virtual meetings enhances client engagement and accessibility, making it easier to build trust and maintain strong relationships with clients.

Even advisors who prioritize in-person meetings benefit from virtual-first accessibility.

Use Data to Refine, Not Guess

The most mature advisors continuously review:

-

Which meeting locations convert best

-

Where drop-offs occur

-

How client preferences evolve

-

Feedback from current clients and an evaluation of their current portfolio to refine meeting location strategy

Location strategy should be reviewed periodically, just as pricing, services, or client segmentation are.

Treat Location Strategy as a Living System

The strongest practices do not “set and forget” their meeting setup.

They adjust as:

-

Team size grows

-

Client mix changes

-

New locations or services are introduced

Financial professionals in wealth management must continuously adapt their meeting strategies to evolving client needs, ensuring their approach remains effective and client-focused.

Meeting location strategy is not static; it evolves with the business.

Wrap Up

Meeting location is no longer a tactical scheduling decision. It is a core component of modern financial advisory success.

Advisors who intentionally design their meeting location strategy convert more leads, deliver a smoother client experience, and protect their productivity as they scale.

The opportunity is not to choose between virtual and in-person meetings, but to orchestrate both with purpose. Advisors who align their meeting locations with client needs, supported by structured appointment setting and the right technology, are better positioned to grow in a permanently hybrid advisory landscape.

Better scheduling starts here

No credit card required